The voluntary CO2 certificate market

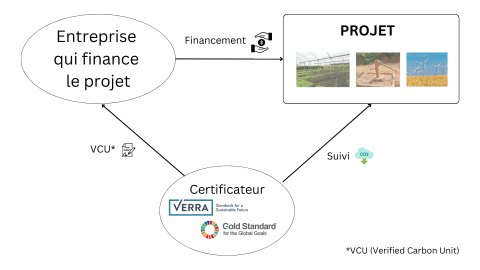

To explain how the voluntary carbon market works, we let a proven specialist have his say. We thank Nicolas Kompalitch for the following text. He is CEO of Canopy Energies, which will in future distribute CO2 certificates from ADES outside the DACH region (Germany, Austria, Switzerland). Canopy Energies aims to counteract global warming by generating clean energy and reducing carbon emissions. We would like to thank Nicolas for his contribution to the ADES blog. The following text is translated from French (and the graphic on how the voluntary carbon market works is in French).

The alarming reports of the Intergovernmental Panel on Climate Change (IPCC) point to the urgency of action if global warming is to be limited to 1.5 degrees.

To achieve this goal, we depend on finding solutions to reduce our global CO2 emissions. In this context, various mechanisms are currently being developed to reduce greenhouse gas emissions, which are the main cause of global warming due to human activities.

A voluntary market

The Voluntary Carbon Market (VCM) is one of these financial mechanisms. It is a trading system that encourages private individuals and companies to finance projects that reduce greenhouse gas emissions or sequester CO2, thus helping to mitigate the effects of climate change. This also allows companies to underline their commitment to sustainability and reducing CO2 emissions.

For each tonne of CO2 reduced or avoided by a project, certification bodies such as Verra or Gold Standard issue certificates to the project promoter. These certificates, generated after the verification of these projects, make it possible to quantify and formalise the impact of the activities carried out: They prove to the companies that financed the project that the measure was implemented.

On the supply side, promoters are very diverse and their projects usually cover developing countries. The projects developed must meet strict eligibility criteria and allow carbon sequestration (reforestation, ...) or avoidance of GHG emissions (improved cookers, renewable energy, ...). To obtain financing, project promoters can therefore resell these carbon credits on the VCM.

In contrast to the regulated market for CO2 certificates, which is imposed on countries or private actors by governmental or financial bodies, the VCM is based on the free choice and will of buyers to finance projects even without any legal requirements.

The price of credits

A carbon credit is equivalent to one tonne of carbon dioxide sequestered or avoided by a project. The average price of a carbon credit in 2022 was €4.95/tCO2eq (tonne of carbon equivalent) according to international standards. However, the prices for these credits vary, depending on the type of project, its location and its socio-economic and environmental aspects.

History and development

The market emerged following the Kyoto Protocol, which was adopted in 1997 and entered into force in 2005, and was the first multilateral agreement to reduce greenhouse gas emissions at the international level. It was from this point onwards that regulated or voluntary carbon markets really emerged. In response to growing concerns about climate change and pressure on private and public actors to reduce, avoid and offset their emissions, the VCM has seen a significant upsurge, especially since 2020. In the last ten years, 836 million tonnes of CO2 have been avoided or sequestered with the help of the VCM, according to South Pole.

The VCM offers numerous advantages. Not only does it provide a platform on a voluntary basis to strengthen commitment to the fight against climate change, but it also creates additional financing opportunities for environmental initiatives through the pricing of CO2 emissions. The VCM thus goes beyond the mandatory greenhouse gas reduction regulations. This approach creates an incentive for a range of additional actors to contribute to the reduction, sequestration and avoidance of greenhouse gases by financing projects.

Case study: The development of the market for CO2 allowances es in Switzerland

Switzerland played a pioneering role in the fight against climate change by setting a target to reduce its greenhouse gas emissions by 8 per cent between 2008 and 2012 compared to 1990. This commitment was intended to achieve the targets announced in 1997 under the Kyoto Protocol. As early as 1999, the Federal Act on the Reduction of Greenhouse Gases (CO2 Act) was passed to provide financial incentives such as tax relief and to encourage companies to reduce their emissions. This law defines an emission certificate system recognised by the Swiss Federal Council, in which emission allocations are levied as tradable rights. These allow the companies concerned to offset greenhouse gas emissions. The allocations are tradable, so companies that have reduced their greenhouse gas emissions without reaching their cap can sell the excess emissions to companies that have to offset their emissions. The law mainly targets companies in the heat generation and industrial sectors (with the goal of reducing the share of greenhouse gas emissions by 8 per cent).

On 1 January 2008, an Emissions Trading Scheme (ETS) was introduced in Switzerland, allowing companies affected by the law to voluntarily contribute to greenhouse gas reductions. In contrast to the cap set in the country by the CO2 Act, the Swiss ETS remained voluntary until 2012. Since then, the law has been revised several times to align with European mechanisms and possibly join the European Union Emissions Trading Scheme (EU ETS).

There are several differences between the functioning of the European and the Swiss market for CO2 allowances. Firstly, the European market distinguishes between a voluntary and a regulated market, which affects the process of credit allocation. Credits from a regulated market are issued through auctions, while in the voluntary market independent organisations determine the number of credits to be distributed based on analyses and audits. Switzerland, on the other hand, does not distinguish between these two markets. Furthermore, Switzerland does not consider carbon credit certificates as financial instruments. The architecture around these certificates is therefore particular depending on the country, and an adjustment to Switzerland's political environment would be necessary to bring it closer to the European market.

The integrity and credibility of projects on the VCM and the role of certifiers

To access these markets, project promoters have their initiatives certified by certification bodies. These standards set eligibility criteria that ensure a project is financed, implemented and operated for a minimum period of time before it receives carbon credits. The certification body rigorously assesses the specifics of the project and awards carbon credits based on avoided or sequestered carbon emissions, which are verified through regular independent audits and approved by the carbon standards. In this way, carbon credits demonstrate an already achieved and proven impact and ensure the credibility of environmental initiatives.

The standards, of which the best known are Gold Standard and Verra (also known as VCS, Verified Carbon Standards), set their own criteria for eligibility. However, there are basic criteria common to all standards to ensure the credibility and integrity of the projects: measurability, verifiability, permanence and additionality:

Measurability and verifiability: The methodologies used to measure and quantify project-related carbon emissions must be transparent, detailed and easily accessible. The credibility of carbon credits is strengthened and ensured when data is verified by external bodies audits.

Durability: The reduction of carbon emissions is irreversible, i.e. the carbon captured or avoided cannot be released into the atmosphere.

Additionality: The carbon emissions avoided, reduced or captured would not have been possible without the implementation of the project.

The standards for verification

With 200 million carbon credits issued by Verra and 100 million by Gold Standard, both labels have gained a high level of credibility and are now recognised internationally as the major players in this field. This is due to their commitment to promoting the transparency and reliability of the credits they issue, their robust methodologies and their sophisticated monitoring over the lifetime of the projects.

The carbon standards differ in their specific requirement criteria and their experience in different areas. For example, the Gold Standard sets particularly high requirements for environmental, social and economic co-benefits and impacts on local communities. All contributions to sustainable development that do not directly consist of avoided or sequestered carbon emissions are defined as co-benefits. Thus, job creation, promotion of access to education or health and all other contributions related to the United Nations Sustainable Development Goals (SDGs) are valuable assets to promote project financing.

In addition to the major players in this market, there are complementary standards whose requirements relate to more specific aspects. The CCB (Climate, Community, and Biodiversity) managed by Verra, for example, pays special attention to climate benefits, local biodiversity and the communities affected by the projects. The Puro Earth Standard, on the other hand, only credits projects that reduce and sequester carbon. Other standards are even more specific, such as Plan Vivo, which only certifies agroforestry and land use projects.

Ultimately, project promoters turn to the label that is most credible, trustworthy and aligns best with their project's objectives.

Upcoming changes: The Integrity Council for the Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Markets Integrity Initiative (VCMI)

To address concerns about the integrity of projects and the credibility of carbon credit issuers, independent institutions such as the Integrity Council for the Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Markets Integrity Initiative (VCIM) play a crucial role in the VCM. Their aim is to ensure the quality, transparency, credibility and accountability of voluntary market participants so that companies can finance trustworthy projects to reduce or avoid CO2 emissions.

Recently, these two important institutions have collaborated, resulting in the publication of a guideline, the "Claims Code of Practice". This code is intended to ensure uniformity of standards and eligibility criteria. The main tasks of this guide are to provide criteria, recommendations and advice for both the reduction of greenhouse gas emissions and the use of carbon credits.

In addition, the Core Carbon Principles (CCPs) established by the ICVCM aspire to become a global benchmark for carbon credit integrity with strict thresholds for sustainable development.

Through the CCPs and the Claims Code of Practice, a set of principles based on accurate science, rigorous analysis and verifiable data, these high standards for carbon credit issuance and investment ensure responsible analysis and management. These criteria, set by the VCIM and ICVCM, strengthen transparency and confidence in a fledgling market to promote its reliability and soundness.

Conclusion

The voluntary market for CO2 certificates is based on a simple principle: private individuals and companies should be able to voluntarily invest in projects that avoid greenhouse gas emissions or sequester carbon, thereby generating carbon credits. Over the last two decades, the carbon credit market has expanded significantly and continues to gain momentum due to the sustainable environmental, social and economic benefits it supports.